FP&A for Beginners: Small Business Owners Edition - The Most Important System For You To Set Up This January

January is here, a fresh start and a clean slate for the New Year. Now is a great time to review your FP&A processes if you have them. Let’s be honest; as a small business owner, you may be asking yourself “What the heck is FP&A and why do I need it?”– in which case, now is the perfect time to begin.

What is FP&A?

Financial Planning and Analysis (FP&A) refers to the process of budgeting, forecasting, and analyzing financial data to guide business decisions.

It’s more than just looking at your P&L (Profit & Loss) and sending your numbers over to your accountant: it’s a way of ensuring that your business’s financial health is closely monitored, plans are in place for growth, and adjustments are made as needed. While large corporations often have dedicated FP&A departments, small business owners can benefit greatly from adopting these practices on a smaller scale, or perhaps by hiring a Fractional CFO to do this important and specialized work.

Why is FP&A important for Small Business?

Informed Strategic Decision Making – helps bridge the gap by providing insights backed by data

Identifying Trends – over time, trends and patterns appear that may not be obvious at first glance

Improved Cash Flow Management – cash is the lifeblood of any business, and ensuring liquidity when needed is paramount

Better Budgeting & Forecasting – helps you allocate resources, plan for slow periods and allows you to plan initiatives

Start FP&A in Your Business

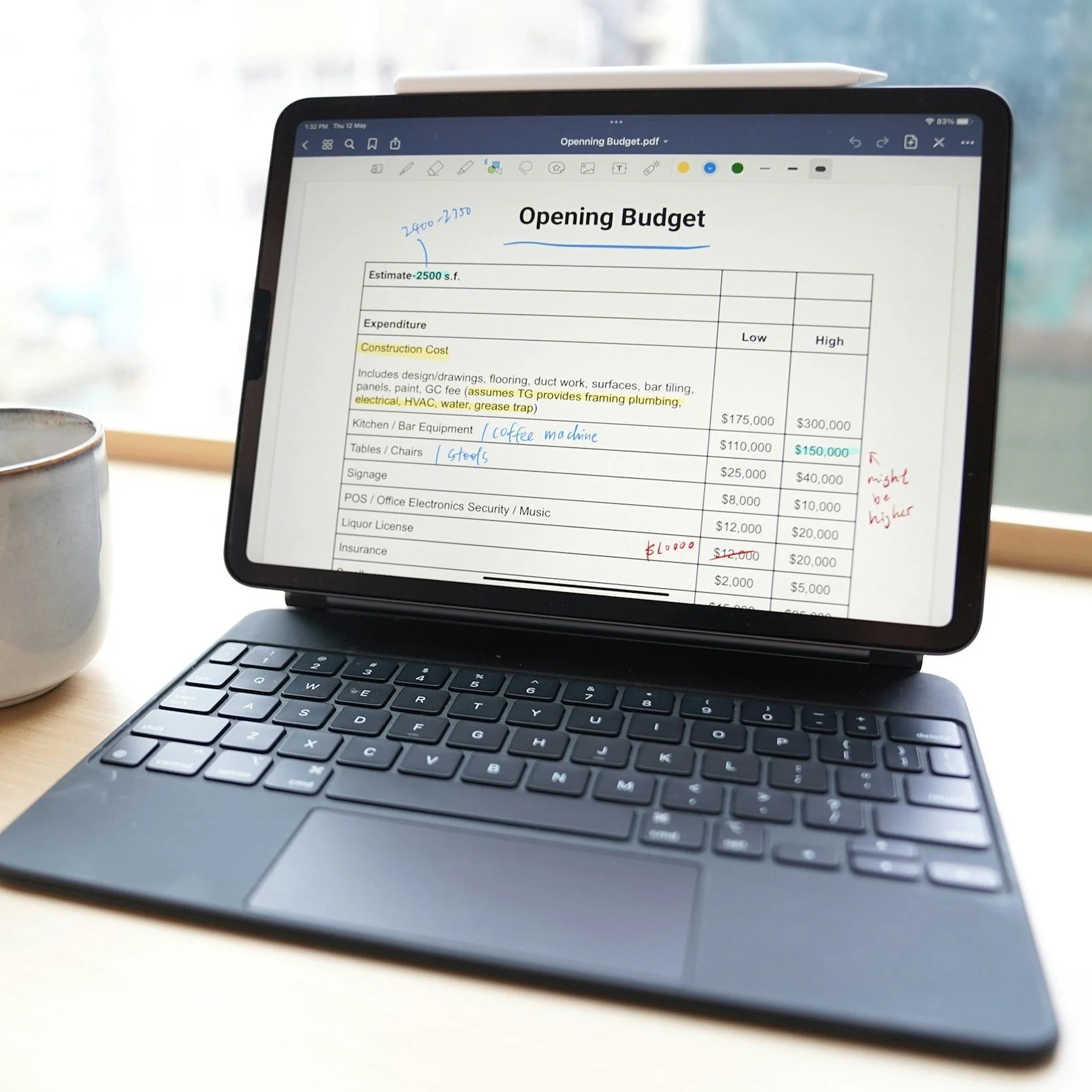

Getting started with FP&A doesn’t have to be overwhelming. The first step is organizing your financial data and building up a budget. Budgeting is the foundation of FP&A. It serves as a measuring stick of your business’s performance for the year. By this time, hopefully you have your budget (nearly) completed. If you have not completed (or even started) your budget yet it’s not too late! Check out this blog post on how to build a zero-based budget P&L so you can start your new year off right.

What next?

Once your budget is completed, what do you do with it? As previously mentioned, a budget is a measuring stick of business performance to compare to, and as such, measuring monthly actuals vs. budget is a basic building block of FP&A. This is called variance analysis, where you analyze what your actual performance was compared to your budget for a specific period, usually monthly. Variance analysis helps you understand why your actual results differ from your expected results and can reveal inefficiencies or unexpected opportunities.

After you have completed your variance analysis, you need to transform that data into actionable information. This is often called management reporting.

Recommended Read: The Dreaded Budget: Arbitrary Constraint or Useful Tool?

Feel as good as this guy when you see thoes numbers! Photo by Yan Krukau

Management reporting: The process of tracking the variance between actuals vs. budget and typically includes key metrics such as revenue, expenses, and profits/(losses).

It involves the regular generation and analysis of financial data, which is then presented in an easily understandable format to key stakeholders, including business owners, executives, and managers. Over time, effective management reporting identifies trends, allows businesses to make informed decisions about cost controls, investments, resource allocation, and strategic planning. It highlights areas that need attention, such as overspending in certain areas or revenue shortfalls, and helps in adjusting business strategies accordingly.

For small business owners, adopting regular management reporting can improve financial transparency and allow for quicker, data-driven decisions. It not only provides clarity on the company's financial health but also aligns operations with business goals. By making reporting a routine part of FP&A, small businesses can ensure they stay on track for long-term financial success.

Final Thoughts on Incorporating FP&A into Your Small Business

Incorporating basic FP&A into your small business operations can dramatically improve financial visibility and decision-making. By budgeting, forecasting, analyzing trends, and transforming data into information, you’ll be better equipped to handle challenges and seize growth opportunities. As you grow, refining your FP&A practices will continue to be essential for sustaining long-term financial success.

If this sounds like a lot to you, there are professionals like us out there to help.

A fractional CFO or an empowered team of your own can help you implement these basics and help guide your business backed by information.

Turning financial data into actionable information is what a good FP&A team should do, allowing you as the owner to make informed decisions going forward.

If you feel like you have been flying blind, now is a great time to begin your FP&A journey.

Doescher Group is here to help!