Blog

Market Timing: How Do You Know It's the Right Time to Sell Your Business?

When to sell is an age old question. In most cases, we can only answer this question years later with the benefit of hindsight. Trying to figure out the exact right moment to sell your company is an exercise in futility. That said, let’s discuss what we can and cannot say about market timing with the goal of landing at some practical, actionable advice.

Goodwill: What is it and How Does it Impact the Sale of Your Business?

Goodwill is an accounting concept that arises in business sales. You would only know about it if you ever took an accounting course or bought/sold a business. While the technical accounting for goodwill is not important for our purposes, the concept is critical for your understanding as a business owner planning to exit.

Reps & Warranties Insurance: Getting an Edge in the Sale of Your Business

Given that you as the seller plan to no longer own the business, you would probably like to leave as little money behind as possible. In a typical transaction it is not uncommon to see 10% or more of the purchase price held back in escrow or contingent payments for a year or even longer. This is an uncomfortable situation, especially when selling your business to a deep pocketed financial investor with access to the best legal counsel.

On the other hand, if a seller offers a R&W policy as part of the package to a buyer the premium needs to be paid, but the escrow goes away. This makes for a much cleaner transaction.

Post-Sale Employment: How Long and In What Capacity Do You Want to Hang Around?

Rather than wander into this jarring culture shock unprepared, it is important to consider how you’d like your post-sale situation to be handled. In many cases your role will be fleshed out between you and the buyer. So let’s think about this from two specific (and potentially conflicting) points of view.

In or Out? Reconciling Divergent Owner Exit Interests

Do you continue to feel aligned in your mission? Or has life intervened and little-by-little (or all at once), as it inevitably does, have you become increasingly aware that your shared vision diverged somewhere along the way?

This common occurrence, which can be painfully obvious to observers, often goes unaddressed for months or even years amongst business partners. While ignorance may seem like bliss, it can often do real damage to your bottom line, limiting your exit options, one avoided conversation at a time.

There are other options. Let’s discuss some healthier ways to handle such a situation.

We've Got It Handled: The Value of an Outside Perspective

You’ve built an incredible and vastly complex business from your humble beginnings. You worked hard and allowed yourself to learn from every mistake. You’re a lot smarter about a lot of things. But deep down you know your limits. You know you cannot be the expert in everything. You know you need some professional assistance, but you cannot forget how you got burned back in the day.

What do you do now?

Net Working Capital - The Missing Piece in Your Business Growth Plan?

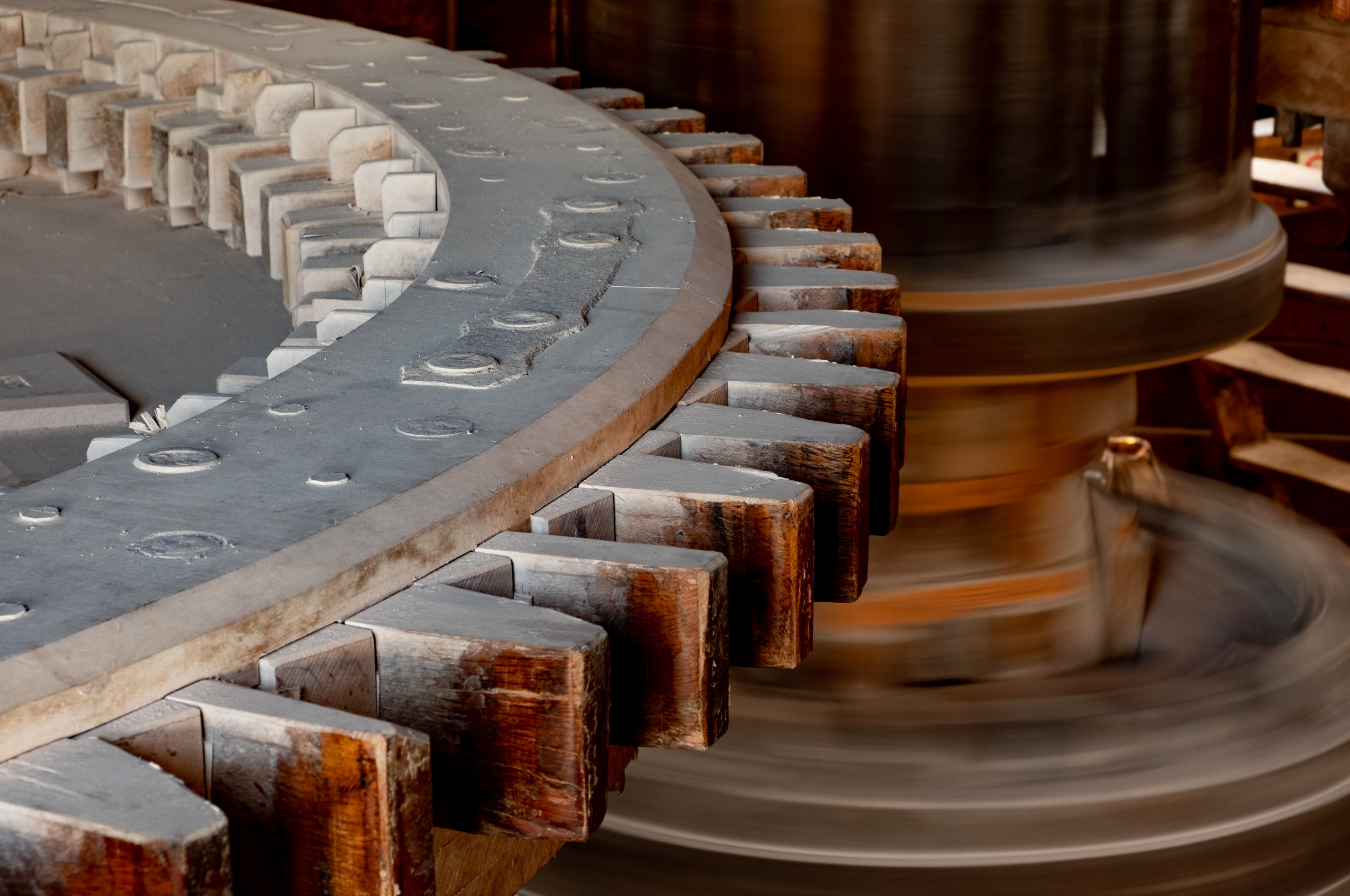

Net Working Capital (“NWC”) is the metaphorical grease that keeps the machinery of your enterprise churning out sales and profits. Yet it is often misunderstood and/or underestimated, especially in growing businesses.

People often joke about how “you have to spend money to make money”. This phrase is often used in the context of capital investments in land, property, plant, and equipment necessary to bring a project from concept to reality. While it’s true that every business requires capital expenditures, the attention afforded to big ticket items like machinery and equipment can result in losing sight of NWC which is necessary to assure the machinery can be run.

Who Spends the Money?

For the past year or more, you’ve realized that your organization has no effective expense control. You simply cannot approve every expenditure anymore without suffocating your business. On the other hand without written policies it seems that every month you get hit with an unexpected spending surprise. There must be a happy medium, right?

The Dreaded Budget: Arbitrary Constraint or Useful Tool?

You can sense the email arriving any moment from your finance director. The subject line will read: “Discuss Next Year’s Budget”. You think, “Is there anything more corporate than a budget?!” Budgeting makes you anxious and has for years.

You wouldn’t even do it if it weren’t a requirement from the bank. This is the moment in every year where you are forced to make definitive statements about the future and put yourself in a box. You do not like being put into a box. You are an outside of the box kind of person.

How to Avoid Being Nabbed by a Shark

You’ve got your anxiety about the inevitable: your exit from your company. You’ve heard a few stories and you know that selling your company is just as competitive as making a buck in your industry.

In your day-to-day business, you know the market and you’ve played the game for decades. But in the market for the buying and selling of businesses, you know it’s an unfair fight. You know that someday soon you’re going to need to step into the ring.

The Two Languages of Business

As an entrepreneur, you can see the future. Where others see an open field, you see a beautiful state-of-the-art facility churning out new products. Where others see an empty shell building, you envision an automated line that will cut operating costs in half. Where others see an abandoned storefront, you see a new retail concept.

You speak the language of a business operator.

But as you know, sometimes you need a financial partner in order to bring your future vision into reality.

The Roundabout Way to Maximizing Value

When it comes to the sale of your business, the most prized assets are the ones that have the highest potential to generate recurring future cash flow for the new owners. So the key to a successful business sale is not historical or present cash flow, but transferable future cash flow.