Normalizing EBITDA (Why You’ll Look at Your Expenses in a Totally Different Way)

The ability to expense things is one of the great perks of owning a business

Remember that incredible business trip you took to Italy last year? No doubt, it was a work trip. You did indeed conduct business. But just between us, did you have to bring your wife and kids? Did you need to stay in the legendary villa? Did you need to try all the wines with your clients that day? Did you need to go for two full weeks instead of three business days?

No criticism implied; the ability to expense things is one of the great perks of owning a business. Furthermore, for years you have probably been trying to lower your net profit in every way (legally) possible to minimize your tax exposure or for personal reasons. Maybe you hire family members for slightly more than you’d pay a stranger. Perhaps the company car is a little bit flashier than is truly necessary.

Resource: Cash Sales and Personal Expenses: A Business Owner's Quandary

Not only does this help come tax time, it’s the kind of leeway and freedom that makes the ups and downs of entrepreneurship worth it.

But when you’re ready to exit your business,

suddenly all these extra expenses can work against you.

That’s because the valuation of your company is based on a key metric many people have never heard of: your EBITDA.

If you’re trying to show your business at its most lean and profitable for a potential buyer, there might be quite a few expenses you might want to rethink.

Don’t worry, you’re not alone. That’s why part of any exit strategy will be to normalize, or adjust, that key number.

So, what is EBITDA and why should you “Normalize” it?

First let us start with what is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation and Amortization. EBITDA is used to evaluate your company’s operating performance and ability to generate cash from ongoing, day to day operations. While many business owners may never see what their EBITDA number is, as it will never appear on your tax returns, it is a useful tool in comparing and valuing your business as you prepare to exit.

Resource: The Essential EBITDA Tutorial - What is “EBITDA” anyway?

What can be even more important is normalizing, or adjusting, your EBITDA. What this does is take out non-operating expenses from your company’s performance to get a true picture of how your core business is performing.

Why you might need to normalize your EBITDA?

There are many reasons why you may need to adjust your EBITDA number. This may sound like fancy financial manipulation, but in reality, it is good practice and offers more transparency into your business’s financial performance.

Any potential buyer will scrub this number to get to a normalized EBITDA value. As most valuations are based on a multiple of your EBITDA, these adjustments can have a large impact on the implied value of your business – we will see an example below.

Having an experienced professional analyze and calculate these adjustments can help you get the best value for your business – and no owner wants to leave money on the table!

Some common examples of EBITDA adjustments include:

Adjustments to income

Rent normalization to market rates – especially if you own the building your business operates in

Compensation adjustments to align with what a typical non-owner CEO or management staff would make at market rate

Personal expenses not directly related to your businesses core operations

You may have family members on payroll

Personal insurance expenses such as life, auto and health insurance for family members

Personal vehicles and related expenses not used for core operations

Personal travel expenses not directly related to the operation of the business

Personal memberships or entertainment expenses like event tickets

Discretionary bonuses above or below typical market rate

Non-recurring or one-time adjustments like:

Start-up costs

Acquisition and integration related costs

Legal fees related to litigation

Advisor and legal fees as you prepare to exit your business

Asset impairments

Inventory write-offs and write-downs

Professional/consulting fees

While it may be tempting to try to add back as many expenses as possible to increase your EBITDA, it is important to remember that buyers may scrutinize these adjustments.

Having too many adjustments can set off alarm bells from a buyer’s point of view.

It is important to remember that these adjustments must have valid reasoning behind them and be defensible during the due diligence process. This is a great reason to seek out a professional advisor on your team as you prepare your business for the exit process.

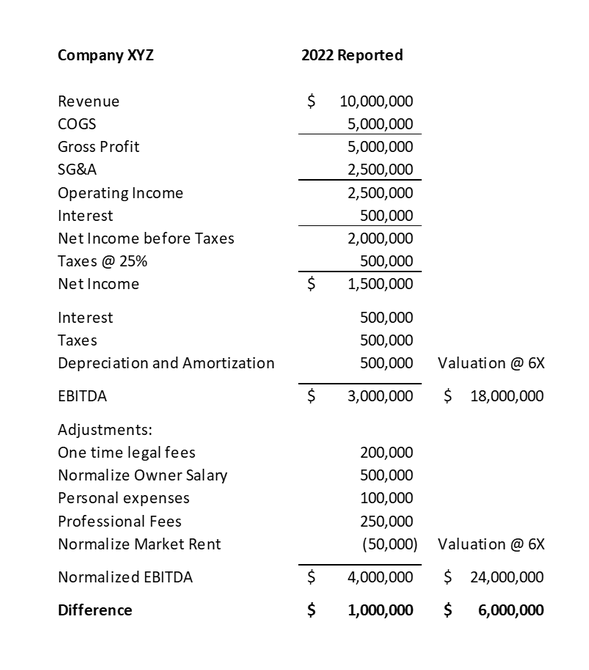

Below is an example of how normalizing EBITDA can have an outsized effect on your business’s value.

As an owner, you may be running both company and lifestyle expenses through your business, but by adjusting these items, we can use the normalized EBITDA as the basis of the valuation.

You can see that Company XYZ has a reported Net Income of $1.5 million and EBITDA of $3.0 million. As we make adjustments to normalize our EBITDA, you can see that it increases the base valuation number by an additional $1.0 million.

Considering a 6 times EBITDA multiple for Company XYZ, this creates an additional $6.0 million in value for the company, so instead of being valued at $18 million you are now looking at $24 million – that is a 33% increase just by identifying and adjusting these items!

At Doescher Group, we specialize in helping owners exit their business well, on their own terms. If this sounds like you, one of our strengths is bringing your financial reporting to a best-in-class level to help you achieve your goals.

Reach out to us today to learn more.